|

María

Rosa Cardona is the queenpin of Cava Rovellats, the renowned Spanish

winery in Catalonia, an hour east of Barcelona. María

Rosa Cardona is the queenpin of Cava Rovellats, the renowned Spanish

winery in Catalonia, an hour east of Barcelona.

A lawyer and photographer, she’s the blonde sparkplug of the

210-hectare estate in Penedès established in 1303 that makes

sparkling wine from highly coddled grapes.

Her wines are carefully aged six years on the lees (the spent yeasts)

after the second fermentation in the bottle, a technique shared with

Champagne icons Krug and Roederer to produce complex, elegant bubblies,

at a fraction of the French price!

Today, Rovellats also makes whites and red table wines from Spanish and

French grapes. The native Parellada, Xarel-lo and Macabeo are

judiciously blended with a little Chardonnay.

The red Monastrell and Tempranillo grapes combine to make the delicious

Rosé Brut and Bru de Tardor ‘02 is Cabernet Sauvignon, Merlot

and Garnacha, aged in French oak and very nicely New World in style.

Blanc de Primavera is Parellada, Xarel-lo and Chardonnay without oak,

round and aromatic, great with cream-sauced dishes, mild cheeses and

poultry.

The 100% Chardonnay, also unoaked, is elegantly fruity with a spicy Mediterranean flair.

Rovellats, in small production but of superior quality, sells mainly

through Spain's finest restaurants. Little of the wine leaves Spain but

Piatto chef and wine importer Fernando García of Spain Only 1

brings some here (call 416 888 7253)

Whites: Chardonnay ‘04, $19.90, Blanc de Primavera ‘04 $15.50.

Cavas: Rosé Brut $24, Chardonnay Brut Nature $28, Imperial Brut

$34.15, Masía S.XV Brut Nature (6 years on the lees) $34.15,

Gran Reserva Brut Nature $29.00, Brut Reserva $23.50, Magnum Brut

Nature $55.

Red: Bru de Tardor ‘03 $28.05

* Meanwhile, in other Spanish news, global warming is starting to harm

vineyards in southern Spain and forcing growers to consider moving to

the cool Pyrenees. Winemakers are already shading their vines,

developing heat-resistant strains and relocating to the mountains.

Temperatures may rise 7C by 2099, says José Manuel Moreno at the

University of Castilla La Mancha. Spain’s average summer high is 29C.

Winemakers must plan ahead because vines produce for 80 years and are

exposed to generations of warming temperatures, says Richard Smart, the

respected Aussie consultant who advises on climate change.

Spain is the closest major producer to the equator, and particularly

vulnerable to climate changes. One degree of climate change makes

wine-growing regions similar to regions 200 km further south, says

Bernard Séguin of France's National Institute for Agronomic

Research.

Regulators should allow winemakers to irrigate, says Spain’s Federation

of Winemaking Associations, which is developing heat-resistant grapes

in greenhouses.

Wine character is on the verge of radical change, experts are warning.

Computer models show that within 50 years Bordeaux and Napa will rise

by 1.2C, Barolo 1.4C, Rioja 1.3C, Portugal 2C.

Other regions are already near top of the range and drought is a

growing problem. These areas include Penedès and La Mancha in

Spain, Chianti and southern Italy, southern France, the Hunter Valley

in Australia, parts of Chile and the Central Valley of California.

Temperatures in New Zealand, southern Australia, parts of Chile and

South Africa will rise more slowly thanks to more water and less land

mass.

Some reds may lose color, some will lose varietal flavor, and some

whites may disappear, says Richard Smart. “The effect will be profound.”

The

world’s best known brand is changing its name! Gallo of Sonoma, the

largest family wine company, is becoming Gallo Family Vineyards. The

world’s best known brand is changing its name! Gallo of Sonoma, the

largest family wine company, is becoming Gallo Family Vineyards.

The aim is to bring consistency to a multitude of labels and highlight the Modesto-based E&J Gallo's family ownership.

"We really want to create a global brand of Gallo Family Vineyards on

which to unify all these brands," says Stephanie Gallo, marketing

director and granddaughter of Ernest, who founded the firm with the

late Julio in 1933.

The new label combines Gallo of Sonoma, retailing for between US$12-$15

and Gallo’s Twin Valley wines from the Central Valley retailing for

US$5. The grape sources and winemaking remain separate.

The company saw its Twin Valley customers trading up to the Sonoma

wines and felt a common marketing theme would encourage this trend,

Gallo says.

"We're not abandoning Sonoma," says Stephanie. "It's Gallo Family

Vineyards Sonoma Reserve." The line includes single vineyard wines at

US$20-$35 a bottle, and estate wines at US$50-$75.

Gallo is one of the largest vineyard owners in Sonoma County, with

3,100 acres in production. About 500,000 of the 2 million cases

produced at the Dry Creek Valley winery are Gallo of Sonoma, and Gallo

also makes Rancho Zabaco and Frei Brothers there.

Gallo brands such as Louis M. Martini and Napa Valley Vineyards are

unaffected. Last year, Gallo won approval to expand the Healdsburg

winery to produce 4.9 million cases which would make it the largest in

Sonoma County.

Gallo began buying vineyards in Sonoma County in 1971 with the Frei

Brothers’ ranch in the Dry Creek Valley. It launched the Gallo of

Sonoma brand in 1994 with great fanfare.

The transition to Gallo Family Vineyards should be complete by the company's 75th anniversary in 2008.

In

a metaphor for the perversity of wine growing, the heavens chose

exactly the wrong day to open, the opening of a grand new Niagara

winery. In

a metaphor for the perversity of wine growing, the heavens chose

exactly the wrong day to open, the opening of a grand new Niagara

winery.

Helicopters were grounded, buses assembled, Plan B implemented – and

wine scribes bused through the deluge to experience the dazzling Le

Clos Jordanne.

The wines are stunning, a testimony to vision, skill, and deep pockets,

the love child of Vincor and Boisset, now adopted by new Vincor owner

Constellation Brands, biggest wine company on the planet.

Truly Burgundy grown in Ontario, the Pinot Noir and Chardonnay wines

from four vineyards at the village of Jordan put Canadian wines in the

global Big Leagues.

The concept dates back to then-CEO Don Triggs and Jean-Charles Boisset

hitting it off over dinner and saying ”What if we did something

together in Canada....” The inspiration was Alliance, a collaboration

of Inniskillin and Jaffelin, now part of Boisset.

J-C felt a frisson as he walked over the Jordan Bench with its

limestone, clay, silt terroir because it “looks so much like the hills

above Corton and Clos Vougeot.” Translation: bankable in Burgundy

terms.

Journo-turned-winemaker Thomas Bachelder and fellow Quebec winemaker

Isabelle Meunier were hired. The vines were shipped from Burgundy and

planted in 2000.

Nine ‘04s are available in three tiers, and three ‘03s (the first

vintage) will soon be in selected restaurants. Le Grand Clos Pinot Noir

‘04 and Chardonnay ‘04 are $60 and $55 respectively. The

single-vineyard Pinots and Chardonnays from Le Clos Jordanne, Claystone

Terrace and La Petite Vineyard are $35. The Village Reserve wines are

$25.

Vincor President Jay Wright, flanked by Rob Sands of Constellation,

explained that Jordanne’s 130 acres “enjoy similar soil and climate to

the Côte d’Or. High-density planting provides the high

concentration of the wines, whose every stage is carried out gently by

hand, organically, and by gravity. Ecocert Canada certificate received

in 2005.

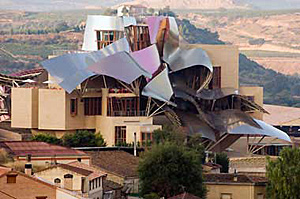

The

crown jewel, down the road, will be a futuristic Frank Gehry-designed

winery with white walls, glass and a “silver cloud” of titanium for the

roof. Gehry designed the new winery of Marqués de Riscal in the

Rioja village of Elciego. The roof is inspired by the swirling costumes

of Flamenco dancers. The

crown jewel, down the road, will be a futuristic Frank Gehry-designed

winery with white walls, glass and a “silver cloud” of titanium for the

roof. Gehry designed the new winery of Marqués de Riscal in the

Rioja village of Elciego. The roof is inspired by the swirling costumes

of Flamenco dancers.

There may be a European wine lake, but there’s one in Australia, too.

Wine in the supermarkets is cheaper than water as a huge Oz glut drives

it below $2 a bottle. Huge harvests for three years have led to a

massive oversupply, with a billion litres unsold, in tanks across the

country. The average price for exports is only $3.78 a litre.

Meanwhile, world prices have tumbled 8% in the year to August. There’s

a massive shakeout in the wind.

Winemakers have seen equity and profits tumble and many growers are

being forced out of business. For consumers, it means wines at a

fraction of the normal price as producers unload stock in generically

labeled bottles known as cleanskins. Export prices have dropped a third

since 2002 and two in five wineries are making losses.

Massive vine plantings have been undertaken since the launch of

Australia 2020, a visionary plan to put Oz wine in the forefront of

world wine production. As a result, for most of the nineties, wine

exports grew at 17% every year, an unbelievable surge. Oz is now the

world’s number four exporter behind France, Italy and Spain.

In the year ending in June, Ontarians drank 14 million litres of

Oz-wine, red and white, a 25% increase, a rate maintained for five

years across Canada (31 million bottles a year, one per Canadian!).

The great Aussie strength is the freedom to blend grape varieties

across huge regions, creating consistent and powerful brands. There are

a few fruit-bearing vines going back to the 1850s and the industry

dates back to 1788 plantings around Sydney.

Even though prices are falling, Australia has displaced France in

volume as the favorite import of the bellwether British market (with

California now in third spot and Italy fourth, followed by S. Africa,

Spain, Chile, Germany, Argentina and New Zealand. )

Meanwhile, Australia has dropped the terms Sherry and Port on its

labels in an effort to gain better access to European. The designation

Port becomes Australian Tawny and Vintage Port becomes Australian

Vintage.

In Europe, consumption has fallen 11% in 20 years and demand for New

World wines is growing. The EU is considering eliminating 400,000 of

its 3.4 million hectares of vineyards.

Per capita consumption in France, Italy and Spain is decreasing, but

the British can't get enough: Brits drank 23 litres of wine each last

year, nearly six more than in 2000. The 10 most popular brands in

Britain now come from Australia and the US, with easily remembered

names (Jacob's Creek, Blossom Hill) and informative labeling.

Even the English wine industry is stealing a march on the French. Many

UK producers have switched to sparkling varieties, with impressive

results. About 350 vineyards, the industry has enjoyed double-digit

annual growth in the last five years.

Please take me back to

the top of the page!

Please take me back to

Being There!

|

|

|